Our webinar with U.S. Immigration and Customs Enforcement (ICE), How to Prepare for the I-9 Audit, ended just minutes ago and covered a lot of ground. Hundreds of questions poured in during the webinar. It was evident that those who participated have a keen interest in protecting their business. This is the first in what will be a series of posts to outline the key lessons learned and to answer the many good questions that we didn’t have time to address during the webinar.

ICE is the largest investigative agency in the Department of Homeland Security. They have more than 20,000 employees working in 400 offices in the U.S. and around the world (source), and are responsible for enforcing the nation’s immigration and customs laws.

ICE audits U.S. employers to ensure employers are processing and retaining I-9s for employees in a manner that is compliant with the law. ICE has a vested interest in educating employers and helping them avoid I-9 fines and criminal sanctions. ICE wants employers to be fully compliant, and so do we. This was the purpose of our webinar.

We’ve seen the number of ICE I-9 investigations grow year over year. We’re now seeing fines that reach into the $ millions. And many of us have cringed as we’ve watched companies learn the hard way that a negative outcome from an ICE audit can bring unwanted publicity.

We’ve seen the number of ICE I-9 investigations grow year over year. We’re now seeing fines that reach into the $ millions. And many of us have cringed as we’ve watched companies learn the hard way that a negative outcome from an ICE audit can bring unwanted publicity.

How likely is it that your organization will get investigated by ICE and have to face these consequences? This is a common question. We heard in the webinar that one thing that influences ICE to choose certain employers to investigate is leads they get from the public as well as from state and federal agencies. Since it is not possible to predict these leads, we recommend instead that you make sure your I-9s are compliant to begin with, before an investigation. This way you’ll sleep at night. A customer of ours who cleansed a large number of I-9s recently described the feeling of relief when he was done. He said, “I sleep well now. I no longer have to live with a ticking time bomb.”

We recommend a good place to start considering how to get your I-9 compliant is to calculate your potential liability if you don’t. The dollar figure can be surprising. The figure is high because the typical error rate is so high.

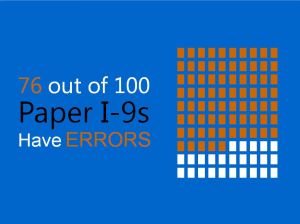

76% of paper I-9s have at least one fine-able error. This error rate is the aggregate result of the million plus paper I-9s that have been processed through our I-9 remediation product. It represents a typical paper I-9 error rate for high-volum e hiring employers with many locations. Compliant I-9 processing is extremely challenging for these organizations. If your organization does a high volume of hiring, has multiple locations, and has paper I-9s, your error rate for those I-9s is likely about 76%.

e hiring employers with many locations. Compliant I-9 processing is extremely challenging for these organizations. If your organization does a high volume of hiring, has multiple locations, and has paper I-9s, your error rate for those I-9s is likely about 76%.

To calculate your potential liability, multiply your number of paper I-9s by 76% to get the number that are likely in error. Now multiply this estimated number in error by the $935 penalty listed in ICE’s I-9 penalty matrix. This is the penalty for first offense substantive and uncorrected technical errors.

So now you’ve calculated your potential liability. What do you do about it?

Check back or sign up to be alerted as we cover these topics from the ICE webinar in future posts:

- 3 ways to clean your existing I-9s

- 5 critical steps to take BEFORE ICE knocks

- The ICE I-9 inspection process

-

You just got an ICE I-9 audit notice: NOW WHAT??

We will also address the questions asked during the webinar that were common across so many attendees.

Discover how Tracker’s auto-cleansing I-9 remediation solution can correct up to 74% of your paper I-9 records automatically, while you sleep.

Disclaimer: The content of this post does not constitute direct legal advice and is designed for informational purposes only.